A little while ago, our director Kelly shared a story about her 19-year-old son, who recently caught the “investing bug.” Like most young adults, he was excited, curious, and ready to see results now.

So she sent him a simple example — something that also happens to be a powerful lesson for all of us, at any age.

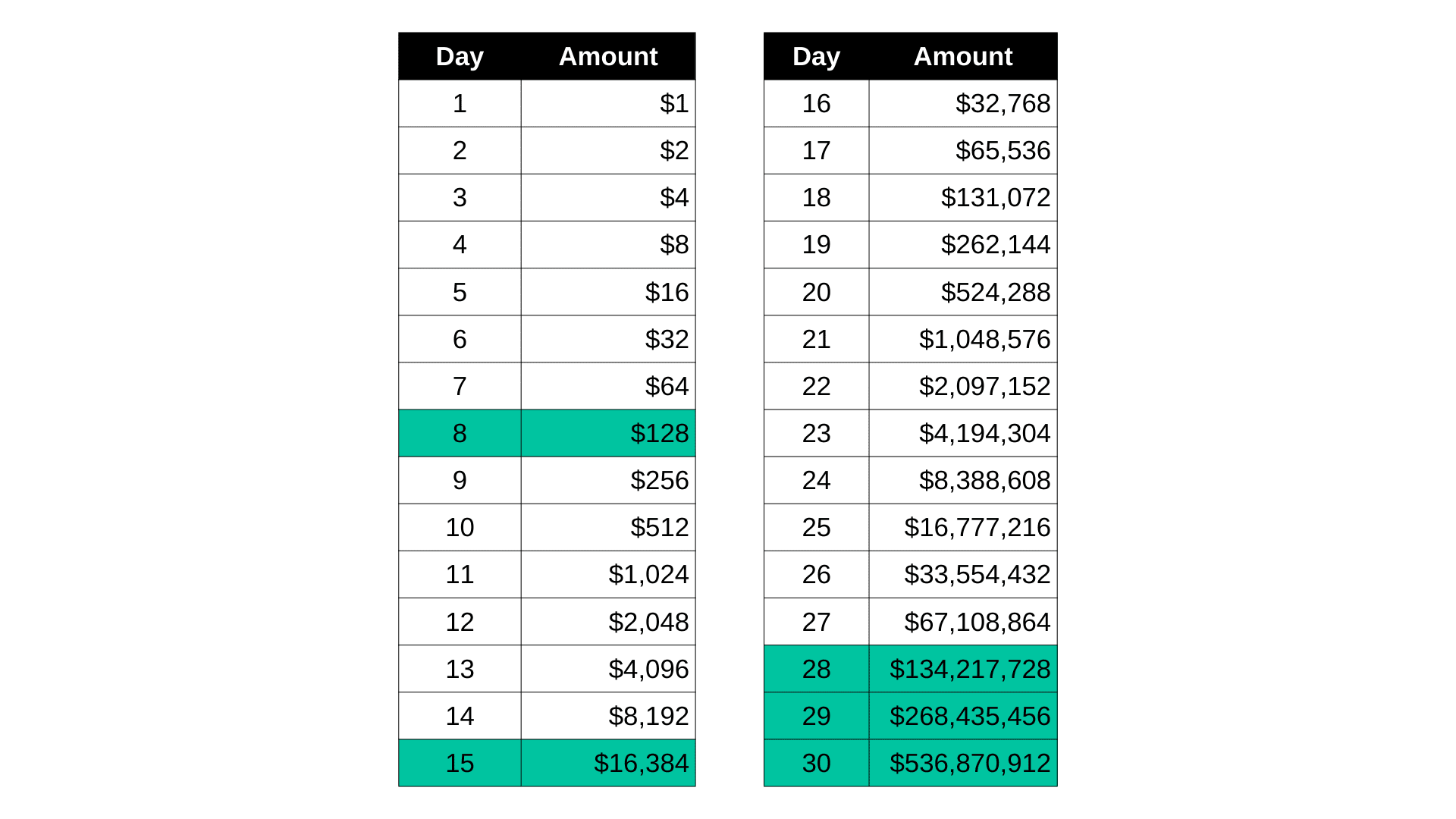

If you take one dollar and double it every day for 30 days, you end up with $536,870,912 !

Of course, this isn’t something a 19-year-old (or most of us!) could ever realistically afford to invest. Doubling your money daily is impossible in the real world. But that’s precisely why the example works — it shows how the real magic of growth happens at the end, not at the start.

Here’s the interesting part:

- On day 8, you only have $128.

- By day 15 — halfway — you’re still only at $16,384.

- The eye-watering numbers only appear right near the finish.

Now, $16k from $1 sounds impressive…

but it’s nowhere near the $536 million that shows up at the end.

And that’s the whole lesson.

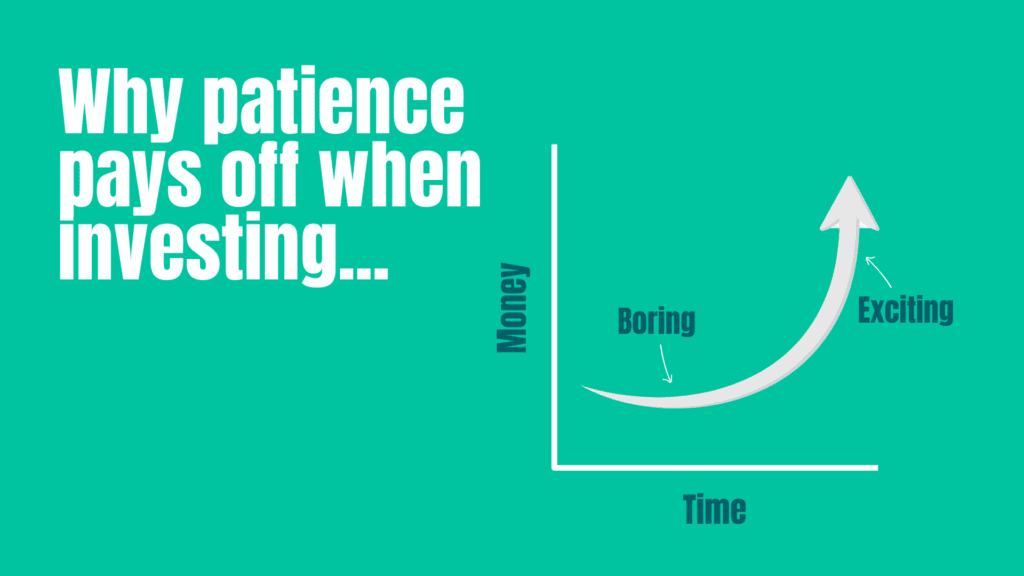

For the first half of the journey, it feels like nothing is happening.

The growth is slow, flat, and frankly… boring.

This is exactly what compounding looks like in real life:

- The early months of investing feel underwhelming.

- The early years of business growth feel frustrating.

- The early steps of building financial discipline feel tedious.

Most people lose patience during this period.

They assume it’s not working.

They change strategies, jump ship, stop contributing, or get distracted.

What they don’t realise is that compounding works like a curve — and every curve starts out flat.

The magic happens after the boring part

Once you push through the slow front end, the curve starts to bend.

And once it bends, it accelerates.

That’s when:

- consistent investing turns into meaningful wealth

- steady business improvement turns into profit lifts

- disciplined financial habits turn into freedom and flexibility

In other words, the big gains are back-end loaded.

You can’t see them early.

You have to earn them through patience and consistency.

Why this matters for investors and established business owners

Most q4 financial clients aren’t trying to double their money every day — they’re established business owners and professionals making strategic decisions about wealth, taxes, structures, and long-term financial independence.

But the principle is exactly the same.

Whether you’re:

- building your retirement balance

- paying down debt

- investing through market cycles

- growing a business asset

- or strengthening financial habits

…the early progress always feels slow.

Your super balance won’t change dramatically in a year.

Your investment portfolio won’t jump every month.

Your business won’t transform with one decision.

But each smart choice adds to the next.

Each year builds on the one before.

Each improvement compounds.

Smart choices today for financial freedom tomorrow.

Compounding isn’t exciting at the beginning — and it’s not meant to be.

But if you stay the course, stay consistent, and stick with the strategy long enough, the results are extraordinary.

That is the power of time, patience, and smart financial decisions.

At q4 financial, we help clients make smart choices today for financial freedom tomorrow — and compounding is one of the most powerful tools to get you there.