We have a new federal budget!

In the wake of Treasurer Jim Chalmers’ unveiling of the Budget 2024/25 last night, we have dissected the key takeaways and implications of the fiscal roadmap laid out for the nation, and in turn, you, our community, and clients. With the next Federal Election on the horizon in 2025 it is hard not to see last night’s announcement as more political than economic.

We watched, have read and now provide a summary of the details and pivotal highlights from Chalmers’ budgetary presentation. From economic forecasts to policy initiatives, we navigate through the critical components of this financial plan, shedding light on its potential impacts on various sectors and demographics.

Federal Budget 2024/2025

The Treasurer is promising that inflation will decline by 0.75% as a direct result of the 2024-25 Federal Budget initiatives including energy relief for all households, a boost to Commonwealth Rent Assistance, and the freezing of the maximum co-payment on the Pharmaceutical Benefits Scheme.

This is a pre-election budget for the people with everyone getting a little something to ease cost of living pressures.

If the consumer price index (CPI) returns to target by the end of 2024 off the back of the Budget initiatives as the Government anticipates, the Reserve Bank of Australia (RBA) may be inclined to reduce interest rates. However, at this stage, the RBA is not expecting inflation to return to the target range of 2-3% until the second half of 2025, and to the midpoint in 2026.

For business, the Government is picking winners through targeted public investment with its Future Made in Australia Framework that they are betting will pave the way for private investment in net zero transformation and the strengthening of Australia’s domestic economic resilience.

For small and medium business, there is a little but not a lot – an extension of the $20k instant asset write-off until 30 June 2025 and a $325 rebate to eligible businesses towards 2024-25 energy bills.

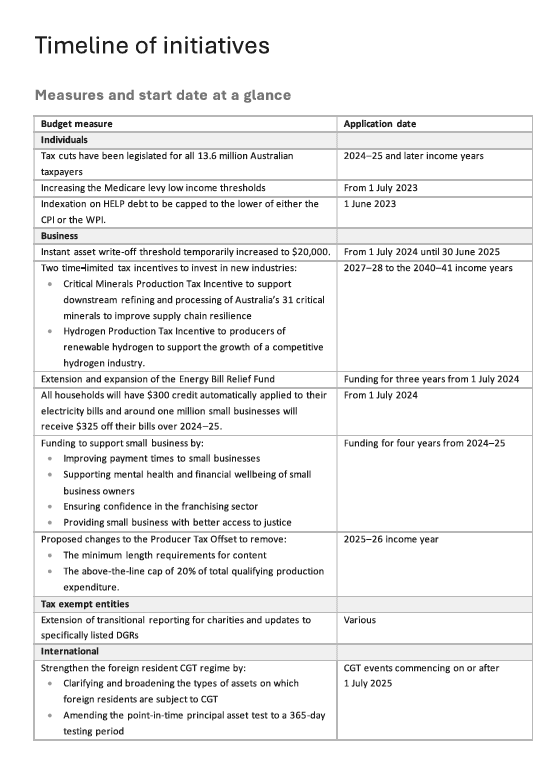

Key measures:

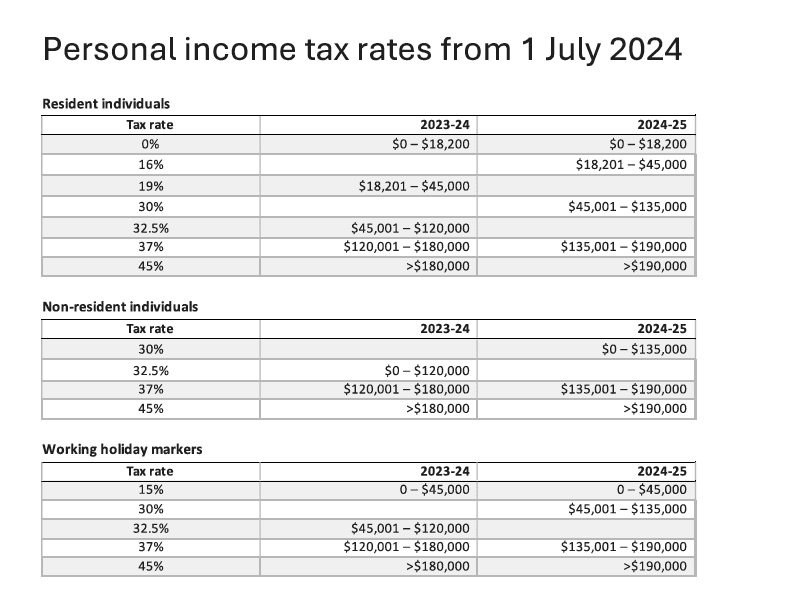

• Previously announced Stage 3 tax cuts (greater detail below).

• $300 energy bill relief for all Australian households and $325 for eligible small businesses – applied as an automatic quarterly credit.

• Student HELP debts will be cut by changing the way indexation is calculated. From 1 June 2023, it will be the lower of the CPI or the Wage Price Index (WPI), reducing the debt accumulated by more than 3 million Australians when the CPI spiked to 7.1%.

• Increase to the Commonwealth rent assistance maximum rates by 10% from 20 September 2024.

• One year freeze on the maximum Pharmaceutical Benefits Scheme (PBS) patient co-payment for Medicare card holders and a five-year freeze for pensioners and other concession cardholders.

And unfortunately, those with large superannuation balances will be disappointed that the 30% tax on super earnings on balances above $3 million remains in place, this is set to commence from 1 July 2025.

The economy Key statistics:

• GDP – Real GDP growth of 1.75% in 2023–24. Growth is expected to remain subdued at 2% in 2024-25 and 2.25% in 2025-26.

• Inflation – The Government expects inflation to be within target by the end of 2024. The RBA’s most recent view is that inflation is not expected to return to the target range of 2- 3% until the second half of 2025, and to the midpoint in 2026. Global inflation remains elevated and is not expected to return to central bank targets until 2025.

• Unemployment – The unemployment rate remaining near its 50 year low at 3.8% – the participation rate is near its record high at 66.6%. Unemployment is expected to rise but remain below pre-pandemic levels.

• Wages – Nominal wages over 2023–24 have grown at their fastest rate in nearly 15 years. It is expected to soften to 3.25% in 2024-25 and 2025-26. Real wages are expected to continue to pick up and grow by 0.5% the year to the June quarter 2024.

The first four years of this decade have tested the economy and the resilience of all Australians: floods and bushfires, a once-in-a century global pandemic, followed by the most significant international energy crisis in 50 years. The combined impact of these events resulted in economic consequences on supply chains, energy prices, inflation, and interest rates. These events may seem like distant memories, but they continue to impact our economy.

Australia is continuing to face ongoing global uncertainty stemming from persistent inflation in North America; growth slowing in China and other major economies; the United Kingdom and Japan both finishing the year in recession; and tensions rising in the Middle East and Eastern Europe.

Inflation and cash rate Inflation is moderating but still high compared to the target range of 2 to 3% required by monetary policy.

Inflation has increased the cost of living, as Australian households are paying more to purchase the same goods and services.

The surplus in 2022–23 took some pressure off inflation, allowing the Government to fund their priorities and reduce debt interest. All encouraging signs, but the Government acknowledges it still needs to reduce inflation further and faster. The budget measures seek to ease inflation and not add to it.

The cash rate is currently at 4.35%, the RBA last raised the cash rate on 7 November 2023 by 0.25% to return inflation to the target range in a reasonable timeframe. The price of goods is moderating but services remain inflated. Overall, higher interest rates have led people to cut back on spending. This is slowing economic growth and bringing demand into better balance with supply.

q4’s take on the 2024/25 Budget

Business & employers

$20k Small business instant asset write-off extended

Small businesses, with an aggregated turnover of less than $10 million, will be able to immediately deduct the full cost of eligible depreciating assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2025. This measure extends the 2023-24 Budget announcement to the 2024-25 financial year. “Immediately deductible” means a tax deduction for the asset can be claimed in the same income year that the asset was purchased and used (or installed ready for use).

$325 energy relief for small business

Around one million small businesses will receive $325 off their energy bills over 2024–25. The support will apply as an automatic quarterly credit to energy bills. Energy relief will also be provided to households in the form of a $300 rebate. Costing $3.5bn over three years from 2023-24, the measure extends and expands the Energy Bill Relief Fund.

Expanding the Digital ID System

The Government is expanding the Digital ID System. The expanded system will lower the administrative burden on small businesses by reducing the amount of ID data they need to store and protect for their customers and their employees.

Building cyber resilience for small businesses

The Government is supporting small businesses to be secure online while they adopt and harness digital opportunities, including through funding the following:

• Cyber Wardens program to provide free, online training for small business owners and their staff to help drive cultural change and a cyber safe mindset in Australian small businesses.

• Small Business Cyber Resilience Service to help small businesses build their cyber resilience and provide support when affected by a cyber incident.

• Cyber Health Check online interactive tool to enable small and medium businesses to self- assess their cyber security maturity.

The Government is also developing a ransomware playbook to provide guidance on how to prepare for, respond to and recover from, a ransomware or cyber extortion incident.

Individuals & families

Personal income tax cuts confirmed

As previously announced, the Government has legislated permanent tax cuts for all Australian taxpayers from 1 July 2024. Relative to the previous Stage 3 plan, the redesigned cuts broaden the benefits of the tax cut by focussing on individuals with taxable income below $150,000.

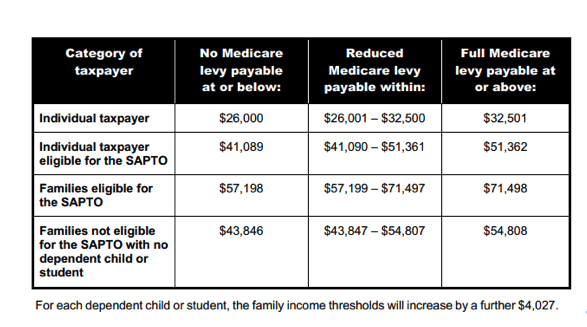

Medicare levy low-income thresholds increase

The Medicare levy low-income thresholds will be increased for singles, families, and seniors and pensioners from 1 July 2023.

The increases to the thresholds take account of recent movements in the CPI so that low-income taxpayers generally continue to be exempt from paying the Medicare levy.

$300 energy relief for households

Households will receive a credit of $300 on their energy bills credited as automatic quarterly instalments across 2024-25. Energy relief will also be provided to eligible small businesses in the form of a $325 rebate. Costing $3.5bn over three years from 2023-24, the measure extends and expands the Energy Bill Relief Fund.

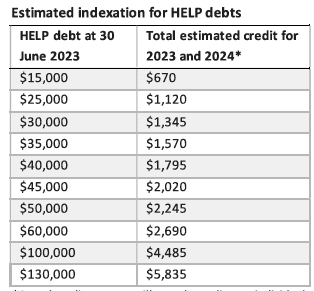

Capping indexation of HELP debts

For accounts that existed on 1 June 2023 – as previously announced, the Government will cap the HELP indexation rate to be the lower of either the CPI or the Wage Price Index (WPI) with effect from 1 June 2023.

The change will apply to all HELP, VET Student Loans, Australian Apprenticeship Support Loans and other student support loan accounts that existed on 1 June 2023.

By changing the calculation of HELP indexation from 1 June 2023, the indexation rate is reduced from:

• 7.1% to 3.2% in 2023, and

• 4.7% to around 4% in 2024.

The change resolves an issue for more than 3 million Australians with a HELP debt when the CPI indexation rate spiked to 7.1% last year. An individual with an average HELP debt of $26,500 will see around $1,200 wiped from their outstanding HELP loans this year, pending the passage of legislation.

*Actual credit amount will vary depending on individual circumstances including repayments made during the year. All HELP debts that were indexed in 2023 and are subject to indexation on 1 June 2024 will receive an indexation credit.

Tertiary Education Reform

To establish a new ‘Commonwealth Prac Payment’ of $319.50 per week (benchmarked to the single Austudy rate) from 1 July 2025 for tertiary students undertaking supervised mandatory placements as part of their nursing (including midwifery), teaching or social work studies. This will help alleviate the significant financial impact of mandatory placements and increase retention in courses for careers in sectors experiencing shortages.

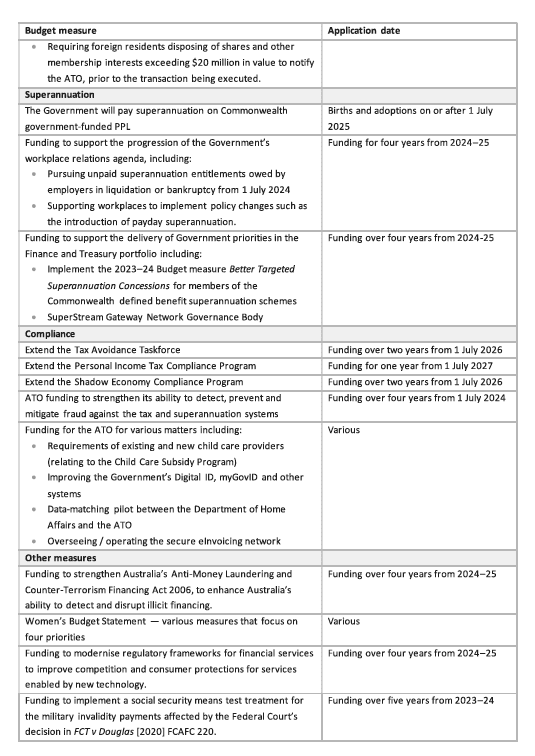

Superannuation on paid parental leave

As previously announced, from 1 July 2025 superannuation will be paid on Paid Parental Leave payments from 1 July 2025. Eligible parents will receive an additional payment based on the superannuation guarantee (i.e. 12% of their PPL payments), as a contribution to their superannuation fund. This payment is in addition to the changes that saw families provided with an extra two weeks of leave (22 weeks total), which will increase to 24 weeks from July 2025 and 26 weeks from July 2026.

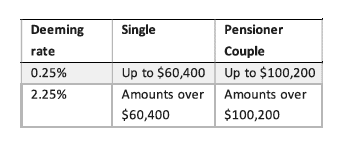

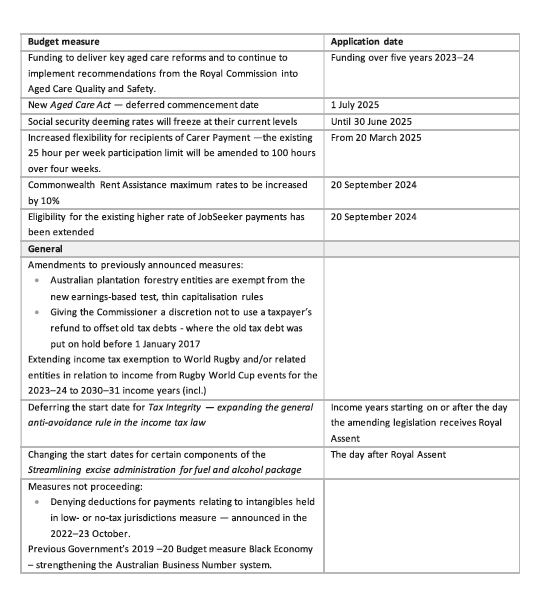

Freezing social security deeming rates

When calculating Centrelink and Department of Veterans affairs payments, rather than assessing the actual income from financial investments, a deemed rate of return based on the total value of these investments is assumed. Some common examples of financial investments include bank accounts, term deposits, shares and managed funds.

The Government proposes to freeze the deeming rates (shown below) until 1 July 2025:

Pharmaceutical Benefits Scheme co-payments

The Government will ensure that the cost of medicines remains low by freezing indexation:

• PBS general co-payments to not be indexed between 1 January 2025 and 31 December 2025 (inclusive), with indexation resuming on 1 January 2026.

• PBS concessional co-payments to not be indexed between 1 January 2025 and 31 December 2029 (inclusive), with indexation resuming on 1 January 2030.

Superannuation & investors

Expanding CGT regime for foreign residents

The foreign resident capital gains tax (CGT) regime will be expanded by:

• Clarifying and broadening the types of assets on which foreign residents are subject to CGT

• Amending the point-in-time principal asset test to a 365-day testing period

• Requiring foreign residents disposing of shares and other membership interests exceeding $20 million in value to notify the ATO, prior to the transaction being executed.

Under current law, foreign residents are subject to CGT when they sell an asset that is classified as ‘taxable Australian property’ (TAP). The rules seek to ensure that non-residents are subject to Australian CGT on the disposal of assets that have a sufficient connection with Australian land and assets that have been used in business activities in Australia.

Shares in a company and units in a trust can be classified as TAP if the taxpayer and certain related parties hold at least a 10% interest in the entity and where more than 50% of the gross market value of the assets held by the entity is attributable to real property located in Australia and similar assets.

The measure is intended to ensure that Australia can tax foreign residents on direct and indirect sales of assets with a close economic connection to Australian land, bringing the treatment more in line with the tax treatment that already applies to Australian residents.

The new ATO notification process will improve oversight and compliance with the foreign resident CGT withholding rules, where a vendor self-assesses that the sale doesn’t involve TAP.

The proposed reforms will also align Australia’s tax law for foreign resident capital gains more closely with OECD standards and international best practice.

The Government will consult on the implementation details of the measure, which is estimated to increase receipts by $600 million and increase payments by $8 million over the five years from 2023–24.

Extending ATO compliance programs

Cracking down on multinationals, large public and private individuals and high-wealth individuals will be the focus of the tax office’s Tax Avoidance taskforce, which is being extended by a further two years, until July 2028. Extending the taskforce will cost the government $1.2bn over the next five years, but will raise tax revenue by $2.4bn.

The Government has announced it will extend the following ATO compliance programs:

1. Personal Income Tax Compliance Program

The Government will extend the ATO’s Personal Income Tax Compliance Program for one year from 1 July 2027. This extension will enable the ATO to continue to deliver a combination of proactive, preventative, and corrective activities in key areas of non-compliance, including overclaiming of deductions, incorrect reporting of income and inappropriate tax agent influence. This will enable the ATO to continue its focus on emerging risks to the tax system, such as deductions relating to short-term rental properties.

2. Shadow Economy Compliance Program

The Government will extend the ATO Shadow Economy Compliance Program for two years from 1 July 2026. This extension of the Shadow Economy Compliance Program will enable the ATO to continue to reduce shadow economy activity, thereby protecting revenue and preventing non-compliant businesses from undercutting competition.

3. Tax Avoidance Taskforce

The Government will extend the ATO Tax Avoidance Taskforce for two years from 1 July 2026. Extending the Taskforce ensures the ATO continues to be well-resourced to pursue key tax avoidance risks, with a focus on multinationals, large public and private businesses, and highwealth individuals.

4. ATO counter fraud measures

The Government will provide $187.0 million over four years from 1 July 2024 to the ATO to strengthen its ability to detect, prevent and mitigate fraud against the tax and superannuation systems. This will include funding:

• for upgrades to information and communications technologies to enable the ATO to identify and block suspicious activity in real time;

• for a new compliance taskforce to recover lost revenue and intervene when attempts to obtain fraudulent refunds are made; and

• to improve the ATO’s management and governance of its counter-fraud activities, including improving how the ATO assists individuals harmed by fraud.

Retaining Business Activity Statement (‘BAS’) refunds

The Government will strengthen the ATO’s ability to combat fraud by extending the time the ATO has to notify a taxpayer if it intends to retain a BAS refund for further investigation. The ATO’s mandatory notification period for BAS refund retention will be increased from 14 days to 30 days to align with time limits for non-BAS refunds.

Legitimate refunds will be largely unaffected. Any legitimate refunds retained for over 14 days would result in the ATO paying interest to the taxpayer. The ATO will publish BAS processing times online.

This change will have effect from the start of the first income year after Royal Assent of the enabling legislation.

Understanding the nuances of this financial blueprint is important for individuals, businesses, and communities alike.

Contact us if you would like to delve deeper into the Budget 2024-2025 and its implications for you.

Before acting on any General Advice, you should consider whether it is appropriate in light of your particular objectives, financial situation or needs. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) for that product before making any decisions.