Monitoring the health of your business with a regular business health check is a priority. Aside from day-to-day management, there are a variety of areas a business needs to proactively and regularly consider to ensure all that you have worked for and grown remains viable and healthy.

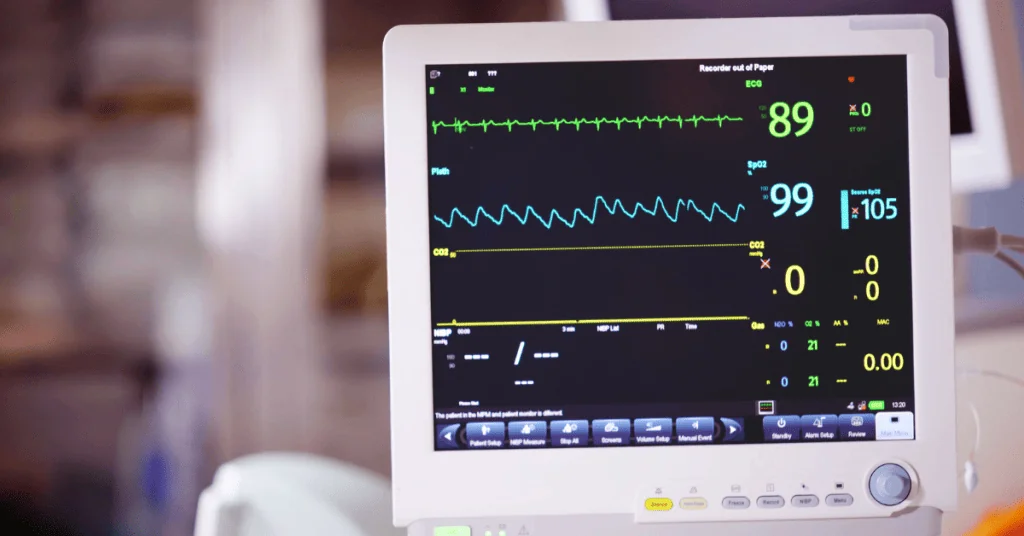

Just like your annual medical check-up where your doctor will cover a range of key areas to ensure your overall wellbeing, regularly checking the health of your business will keep it running at its best. By keeping tabs on some fundamentals that may well fall outside your normal day-to-day management, you can ensure your business remains in good shape, and address any areas of concern that may arise in a very timely manner.

So where to start with building your business health checklist. While there may be metrics specific to your business or industry, below are some ways you can ensure you’re recognising the right areas that might need some consideration.

- Build a list of areas/topics/checks that will be included in your personalised business health check.

- Establish a timetable as to when your checks will take place.

- Record your results. This allows you to check back in on your progress and note any trends.

- Always start by reflecting on the previous health check to ensure the previous periods ‘issues’ have been resolved or are in the processing of being resolved.

- Record any potential ‘health risks’ and clear action to address these, either immediately, or monitored for future attention.

The frequency of your business health check will depend on your particular circumstances. A good starting point may be every quarter, but you could do mini checks monthly, in combination with more, in-depth checks every three or six months.

Plan and measure

Well-managed businesses have clear strategies, milestones, and goals that help direct and manage resources – this is most commonly captured in a business plan. Benjamin Franklin summed it up with his famous statement – If you fail to plan, your plan to fail.

Your business health check should examine how you are tracking in all key areas of your business plan, and whether you are on or off track in achieving your short term and longer-term goals. In short, it should serve as your regular reality check. It helps clearly identify if there have been any minor or major changes in the business environment, such as COVID-19, which will affect your ability to achieve your stated goals. A health check will enable you to consider what the overall effect of such market changes might be, consider how you may address them or assist in adjusting your projections and plans.

Balance Sheet balanced?

Reviewing your balance sheet to make sure it is working as hard as you are should be part of your regular check. So what does that actually mean? Your Balance Sheet can often be ‘lazy’ and needs to be actively managed to ensure you are taking advantage of all that you have. For example, debtors are in check and paying within their allocated terms, interest rates are reviewed and compared to market rates, and that your cash balances are levered to be working for you and your business.

When it comes to your company’s financial wellbeing, accuracy and consistency are everything. Business owners with access to accurate financial statements, have the ability to make timely data-driven decisions to foresee potential cash flow issues, identify areas for growth and devise strategies for cutting costs.

Review, review and review again

This regular review process is a great opportunity to assess your recent financial data to see if your numbers are tracking to your expectations and moving in the right direction.

Each line on your Profit and Loss should be monitored against your expectations (aka budget) and historical trends. It is also possible to benchmark your numbers with similar businesses. This can be a sobering exercise but without knowing, you may never make positive changes.

Managing your margin is key to surviving and thriving. It is common for many businesses that all items above the Gross Profit line (knowns as variable or cost of goods sold) if tweaked positively can provide exponential improvements to those items tweaked below the Gross Profit line (known as fixed costs or overheads). For example, a 10% saving for costs of production or delivery for a business will give a three times better result than saving 10% of overheads (based on GP margin of 40%).

If any areas of concern arise, you can now set out to examine the situation deeper and develop solutions. If there are explanations for any variations record them on your business health check document. If you feel a trend in one way or another may be developing add this to your list for your next health check to examine again on the next round.

Client satisfaction

The business health check should include some client-facing analysis of client feedback, responses, comments, etc. If your business tracks its NPS (Net Promoter Score) this is a great place to start but you can go back to the basics, providing simple opportunities for clients to give feedback or suggestions. Whether this be through google reviews, anonymous surveys, general conversation or staff feedback it is vital to ensure commentary, both good and bad, is captured.

By capturing and checking you can gauge the general status of client attitudes towards your businesses and any new trends that may be evident. Where concerns are raised it is important to bring the right team members together to look at how an issue can be addressed and what processes and learnings can be put in place to ensure improvement versus ongoing concerns.

From the inside out

Building and nurturing your team is critical to the success and growth of any business. Ensuring staff are and feel supported, in both role clarity, responsibilities, personal and career development are important factors to consider. This check provides a good opportunity to check in with HR and managers within your business to ensure internal programs to support and develop employees are functioning well. How we manage our business internally is often reflected externally, so it’s important to recognise the role people play in business health.

Read our insights on Managing Teams – it offers several good questions you may consider including in your vital business health checks. These include:

- Does every member of your team know if they are doing a good job or not?

- Is every member of your management team (you included) comfortable with having difficult and constructive conversations with your team?

- Are you leading by example and demonstrating the behaviours you want to see in your team?

- Are you or your senior team, taking the time to build a connection to your team on an individual basis?

Like all good health checks, if concerning issues are uncovered, they deserve further investigation and action. If minor issues are identified, these can be monitored in the medium term and action taken as required. If no issues are raised, congratulations, your business has a clean bill of health, but remember regular check-ups will ensure it stays this way!

Of course if you’d like some help in establishing your business health check, we are more than happy to assist. Please reach out if you wish to explore how to get a regular check in place so your business not only survives but thrives!