For our clients who process their own payroll we’ve put together some simple step-by-step instructions to help you enrol into the new Single Touch Payroll (STP) Phase 2. It is important to note that the STP (Single Touch Payroll) Phase 2 has been rolling out for a while now and has a deadline to enrol which of 31 March 2023.

As you will be aware, you are required to report payroll information to the Australian Taxation Office (ATO) using the Single Touch Payroll (STP) system. STP requires you to send payroll data to the ATO every time you pay your employees, rather than once at the end of the financial year. This system ensures that the ATO has up-to-date information about your payroll and reduces the need for businesses to submit multiple reports throughout the year.

This guide is specifically for Xero clients. If you are MYOB client and/or unsure please contact us, we are happy to help.

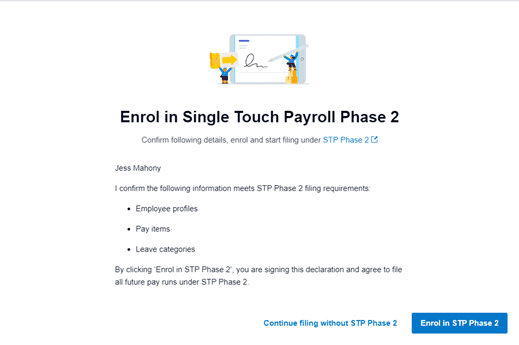

Step 1 – Enrol in Single Touch Payroll

Once you have logged into your Xero account, navigate to the Payroll Tab.

When the most recent payroll period is processed and you lodge with the ATO, you will receive the prompt below.

Please select the button ‘Enrol in STP Phase 2’

Step 2 – You’re now enrolled!

Once you click the enrol button the next screen should confirm that you are now enrolled. Yes, it is that easy!

From here simply select ‘continue’

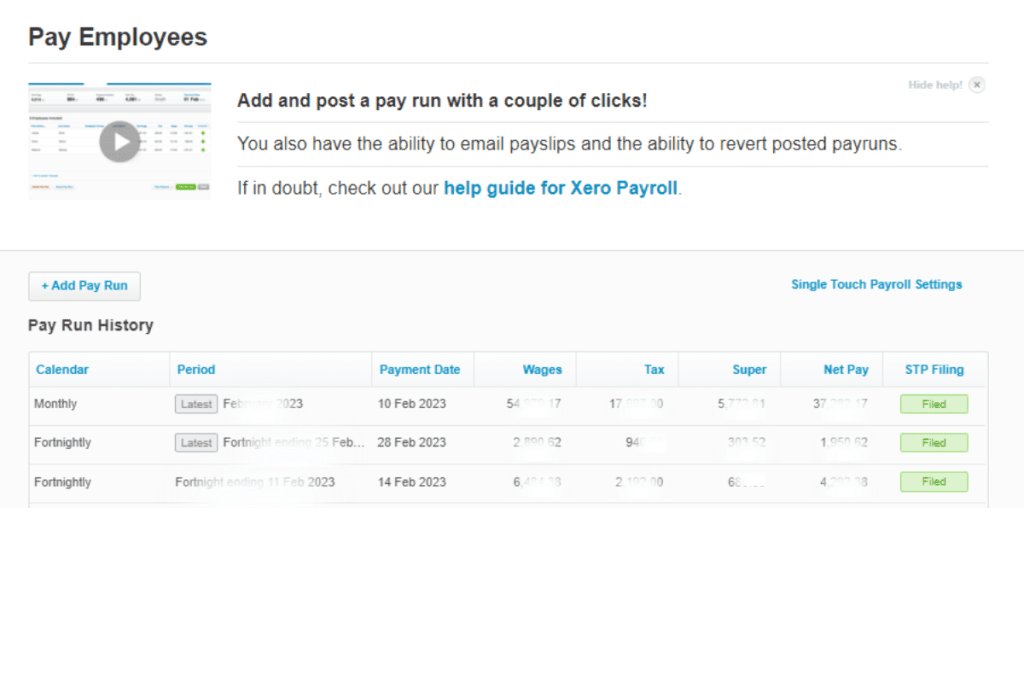

Xero should take you back to the main payroll filing screen (as shown below), where you can continue submitting payroll.

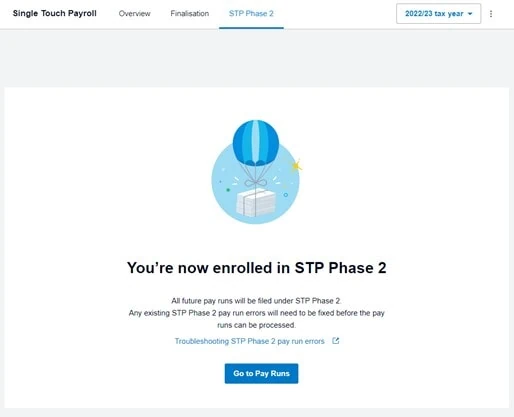

If you are not sure whether you have been enrolled already or not, you can simply check this by navigating the following menu links:

selecting payroll > single touch payroll > STP Phase2

If you see the following screen then you are enrolled. No further action is needed.

Setting up Single Touch Payroll in Xero is a straightforward process that ensures you comply with your reporting obligations to the ATO. If you have any questions or need further assistance, your q4 team is available to help.

You can also get additional support from Xero Support.